cathryn874337

About cathryn874337

The Comprehensive Guide To Gold IRA Investing

Investing in a Gold IRA: A Complete Information

Lately, investing in a Gold Particular person Retirement Account (IRA) has gained recognition among those looking to diversify their retirement portfolios. Gold IRAs present a unique opportunity to spend money on physical precious metals, providing a hedge towards inflation and economic uncertainty. This article goals to supply a comprehensive overview of Gold IRA investing, together with its benefits, potential drawbacks, and the steps involved in setting one up.

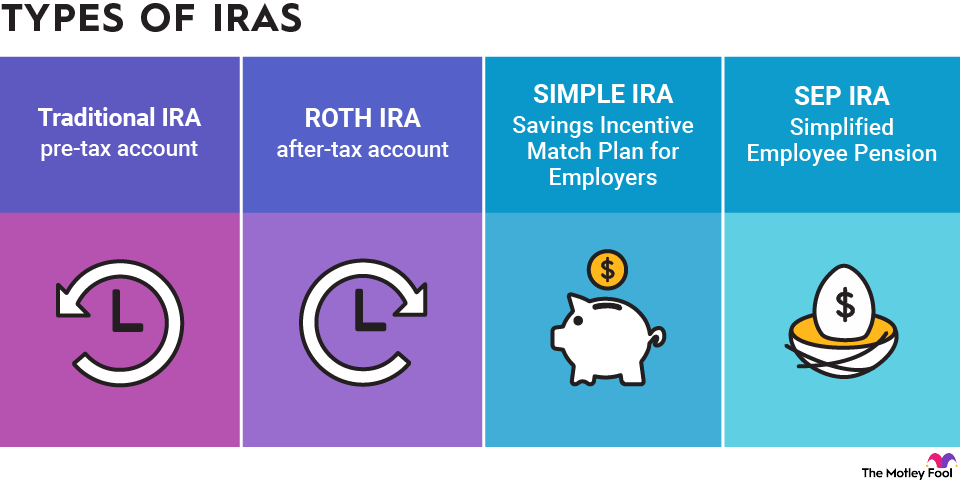

What is a Gold IRA?

A Gold IRA is a kind of self-directed individual retirement account that allows buyers to hold bodily gold, together with different treasured metals similar to silver, platinum, and palladium, as part of their retirement savings. Not like traditional IRAs, which typically hold paper property like stocks and bonds, a Gold IRA offers the ability to put money into tangible property that can potentially retain worth over time.

Benefits of Investing in a Gold IRA

- Hedge In opposition to Inflation: Gold has traditionally been seen as a protected haven asset during occasions of financial turmoil. When inflation rises, the value of paper foreign money usually declines, but gold tends to keep up its buying energy. By including gold in your retirement portfolio, you’ll be able to protect your savings from the eroding results of inflation.

- Diversification: A Gold IRA permits traders to diversify their portfolios past traditional assets. Diversification may also help mitigate threat, as different asset classes typically perform differently beneath varied economic circumstances. Gold sometimes has a low correlation with stocks and bonds, making it an excellent addition to a well-rounded investment strategy.

- Tax Advantages: Like traditional IRAs, Gold IRAs supply tax-deferred progress. Which means any gains made inside the account usually are not topic to taxes until you withdraw funds during retirement. Additionally, when you choose a Roth Gold IRA, you may get pleasure from tax-free withdrawals in retirement, supplied certain conditions are met.

- Physical Ownership: Investing in a Gold IRA means you own bodily gold, which might provide peace of mind for traders concerned about market volatility. Not like stocks or bonds, which exist only on paper, gold is a tangible asset you can hold in your hand.

Potential Drawbacks of Gold IRA Investing

- Storage and Insurance coverage Prices: One among the main drawbacks of a Gold IRA is the requirement for secure storage. Bodily gold have to be saved in an permitted depository, which frequently comes with annual fees. Moreover, buyers may want to purchase insurance coverage for their gold holdings, which may additional increase prices.

- Limited Investment Options: Whereas a Gold IRA allows for the inclusion of valuable metals, it might limit your ability to spend money on different asset classes. This might hinder your general investment technique, notably should you are looking to benefit from high-progress opportunities within the stock market.

- Market Volatility: Though gold is usually thought-about a safe haven, it is not immune to price fluctuations. The value of gold may be affected by various factors, together with modifications in interest rates, foreign money strength, and geopolitical occasions. If you adored this article so you would like to receive more info concerning gold-ira.info nicely visit our own web page. As such, buyers must be prepared for potential volatility of their gold investments.

- Complexity of Setup: Establishing a Gold IRA could be more advanced than organising a conventional IRA. Investors should navigate particular rules and necessities, which can be daunting for these unfamiliar with the method.

Steps to Set up a Gold IRA

- Choose a Custodian: Step one in setting up a Gold IRA is to select a reputable custodian. A custodian is a financial institution that manages your account and ensures compliance with IRS laws. Look for a custodian with expertise in dealing with Gold IRAs and a strong popularity within the business.

- Open Your Account: Upon getting chosen a custodian, you will want to complete the mandatory paperwork to open your Gold IRA. This will likely embody providing private info, selecting the type of IRA (traditional or Roth), and funding your account.

- Fund Your Account: You can fund your Gold IRA through various methods, together with transferring funds from an current retirement account or making a direct contribution. If you are rolling over funds from another retirement account, guarantee that you observe IRS guidelines to keep away from penalties.

- Choose Your Valuable Metals: After funding your account, you can choose which precious metals to put money into. The IRS has specific requirements relating to the sorts of gold that are eligible for inclusion in a Gold IRA. Usually, solely gold bullion that meets a minimal purity commonplace (usually .995) is acceptable. Additionally, certain gold coins, such as American Gold Eagles and Canadian Gold Maple Leafs, are also eligible.

- Buy and Retailer Your Gold: Once you have chosen your treasured metals, your custodian will facilitate the acquisition and arrange for safe storage in an authorised depository. It is important to decide on a depository that meets IRS necessities and gives enough security measures.

- Monitor Your Funding: As with every investment, it’s crucial to watch the performance of your Gold IRA commonly. Stay knowledgeable about market trends and financial circumstances that will impression the value of your gold holdings. This may enable you to make informed choices about your retirement technique.

Conclusion

Investing in a Gold IRA can be a useful addition to your retirement portfolio, providing advantages corresponding to inflation safety, diversification, and tax benefits. Nonetheless, it is essential to weigh the potential drawbacks and complexities concerned in establishing and managing a Gold IRA. By understanding the method and making informed choices, you may successfully incorporate gold into your retirement technique and work in the direction of attaining your long-term financial objectives. As always, consider consulting with a financial advisor to ensure that a Gold IRA aligns with your total investment strategy and danger tolerance.

No listing found.